|

Background

The 21st century will be dominated by the quest for and

access to the world’s energy sources.

It is expected that by 2020, world oil consumption will rise

by about 60%. The two countries with the highest rate of

growth in oil use are

China and India, whose combined populations account for a

third of humanity. In the next two decades, China's oil

consumption is expected to grow at a rate of 7.5% per year and

India’s 5.5% (compared to a 1% growth for the industrialized

countries).

Of the trillion barrels of currently estimated total world

oil reserves, 6% are in North America, 9% in Central and Latin

America, 2% in Europe, 4% in Asia Pacific, 7% in Africa. But

over 70 % of them lie in the West and

Central Asia

and Asiatic Russia ––

Saudi Arabia (25%),

Iraq (11%),

Iran (8%),

UAE (9%),

Kuwait (9%), and 6%

each in Russia and Central Asia. In addition, Russia holds the

world's largest natural gas reserves,

Iran

the second largest and Central Asia in substantial quantities

too. The geological potential in Central Asian states is still

under-explored, so the region may actually contain much more

oil and gas than generally known today.

Kazakhstan,

Azerbaijan,

Turkmenistan and

Uzbekistan

share the majority of the region's hydrocarbon wealth. But

being landlocked countries, they all depend on their

neighbours –– Russia, the Caucasian States of Georgia and

Armenia and Turkey for access via pipelines to the Western

markets and Kyrgizstan, Tazakhstan and Afghanistan to China,

Pakistan and India. While there is already a good network of

pipelines via

Russia,

the new thrust is to create alternative routes to get out of

the bear-hug.

Oil was first discovered in

Azerbaijan

and a primitive oil industry set up in Baku by the early 19th

century. Because of this, Central Asia in the last two

centuries played an important role in the geopolitical balance

of Eurasia. In World War II, during his campaign against

Russia,

Adolf Hitler sought to capture Baku and the Caucasian oil

fields in a bid to replenish his depleted fuel supplies before

attacking the Middle East. After the war, the Soviets took

over control of the Central Asian oil and gas fields. Now with

the collapse of the Soviet Union, the independent republics of

Central Asia realizing oil to be the fastest way for them to

secure their economic and political independence, have sought

to exploit their oil wealth, thereby leading to a renewed

struggle for political and economic hegemony in the region.

Besides

Russia, USA

and China have emerged as the main contenders with

Iran

playing a side role. Their aim is control of oil and gas

production as also the pipelines that deliver the energy

resources. The transit route through Iran to the Gulf would be

the most economical outlet but the US seems determined to

block it, because such a solution will strongly reinforce

Iran’s position in both the world oil market (change over to

Euros from Dollars and transit for the oil) and in the

political context of

West Asia. With

Iraq and

Afghanistan already in its politico-military sway,

undercutting

Iran

is an obvious way for the US to exercise containment of the

emerging world power –– China and keeping Russia within

manageable bounds. This may be the prime reason for making so

much fuss on Iran’s nuclear activities. Japan is another major

importer of oil, for geographical reasons, has made moves only

towards the Iranian and Russia’s Siberian oil and gas reserves

on purely commercial terms.

The 9/11

Effect

The

US undertaking of war on terror after 9/11 and in the light of

the rise of radical Islam, America is now considering

reduction of its dependence on

Middle East

oil. Moreover, to offset the growing influence of

Middle East

oil producers, non-OPEC countries in

Africa and

Russia have increased their production considerably. It has

even been suggested that Russia could take on OPEC and help

shift the hub of global oil supply away from the Middle East.

Even though Russia’s oil production did increase to the point

that it became the second largest exporter behind Saudi

Arabia, its prospects of becoming a key player in the oil

market in the long run are dim because of the depleting

reserves.

United States, which consumes more energy than any other

country in the world, imports roughly half its oil. Hence oil

plays a key role in its strategic manoeuvres in the world in

general (Venezuela/Nigeria/Indonesia) and

Asia in particular. So the great game over Central Asian energy

resources is the ‘flavour’ of the new century.

Russia being

a constant factor, seeks to retain both economic and political

control of the region. In the Soviet era, it had already

connected Azerbaijan and other Central Asian republics to its

territory and

Europe by a network of oil and gas pipelines. The

United States

having now emerged as the world’s sole superpower, has

universal interests. As the world’s leading oil importer

harbouring the major part of the world’s oil industry, it has

a persistent interest and a stake in and preferably a control

of the world’s major oil producers, wherever they are. The

Central Asian oil and gas reserves therefore present a

tempting fare to

US

oil companies, thereby making Washington evince an avid

interest in this region. The politico-military aspect of the

power play has been covered in a previous article

“Central Asia –– A Chessboard of Power Play”. The intricate game over

energy in the region is detailed in the succeeding paragraphs.

Control

over Oil and Gas

For

Russia energy has emerged as a tool for strategic leverage, in

effect replacing its traditional reliance on the "hard power"

of military with a new exercise of the "soft power" of energy

resources. The use of this soft power as leverage consists of

three components. First, it has supplemented, and in some

cases even projected, an effective reassertion of Russian

power and influence within the so-called "near abroad" of

former Soviet states. Most notably, this can be seen in the

Russian dominance over the energy sectors of much of the South

Caucasus and Central Asia. Second, it has also featured the

use of energy as a tool for strengthening state power,

empowering Russia's status as a regional and an Asian power.

And thirdly, it has afforded Moscow an attractive way to

restore its international position and regain its geopolitical

relevance. Russia signed a long-term cooperation accord with

Turkmenistan

covering natural gas exploration, production, processing,

transport, and marketing. Just ten days before this deal,

Gazprom announced having reached a similar agreement with

Kazakhstan over that country's oil resources. It has also a

fair share of the Azeri oil and gas resources though the US

and Europe have managed to cut into the bounty.

Russia

has also succeeded in stalling US political and military

forays in all Central Asian states and at present glides

smoothly over the present and future energy sources of the

region with China as a strategic partner.

In Oct 05,

Beijing

scored a second major geopolitical coup when it completed a

$4.18 billion takeover of PetroKazakhstan Inc. It was, in a

sense, revenge on

Washington

for the blocking of China’s acquisition of Unocal. US oil

majors had made major efforts to lock up

Kazakhstan

oil after discovery of major oil offshore in the Kashagan

field. The Kazakh president Nazarbayev, in spite of having

good relations with Russia's Putin (he was general secretary

of the Communist Party when Kazakhstan was part of the USSR),

kept his reputation of being a sly fox in dealing with Moscow,

and turned down Russia's Lukoil offer for the PetroKazakhstan

Inc, while the Indian bid was pipped by the Chinese. Before

that Condoleezza Rice's company, Chevron, was the lead oil

contractor and operator in the Kazakh Tengiz oil field. Now, a

decade later and with the scope of Kazakh oil deposits

dwarfing others in the region (estimated to be twice that of

North Sea) with its recent confirmed drillings in the Kashagan

field, Nazarbayev has scored a political balance of power coup

by turning to Beijing.

Earlier at the end of 2004,

Beijing

signed a $100 billion deal with Iran to import 10 million tons

of liquefied natural gas over a 25-year period in exchange for

a Chinese stake of 50% in the development of the giant

Yadavaran oilfield. This is China's largest OPEC energy deal

todate and includes construction of related petrochemical and

gas infrastructure as well as pipelines. A second phase in the

Iran–China strategic energy cooperation will involve

constructing a pipeline in Iran to take oil some 386

kilometers to the Caspian Sea, there to link up with the

planned pipeline from China into Kazakhstan. On signing the

deal, Iran's Petroleum Minister announced that Tehran would

like to see China replace Japan as Iran's largest oil

importer. Iran now supplies about 14% of China's oil.

PetroChina recently inked a MoU with

Myanmar to

supply 6.5 trillion cubic feet of gas from Block ‘A-1’ of the

Shwe gasfields in the Bay of Bengal for over 30 years. The

decision came as a major blow to India whose

two state owned companies –– ONGC

and GAIL –– hold 30% equity in it. It also marked one

more victory for

Beijing

energy giants which have consistently been beating Indian

energy firms in the acquisition of oil and gas reserves around

the world. India's state-owned oil giant Oil and Natural Gas

Corporation (ONGC) has lost to Chinese companies, in

Kazakhstan, Ecuador, Angola and Nigeria. Now, with Block A-1

gas from Myanmar going to China, the cost of transportation

will increase as the other available block close to India is

A-2, which will require an additional 150km of pipeline for

the gas to reach here. India’s oil diplomacy has not been

sufficiently geared to meet the competition from China. The

cash-rich Chinese firms are favourably placed as they can

dispense government aid to secure deals as well as draw on

hefty credit lines from Chinese financial institutions.

India has

made moves to buy 7.5 million tons of LNG a year for 25 years

from Iran but the deal has not yet been ratified by the

Iranian President and there is now a question mark over it due

to

India’s

vote on referring Iran’s nuclear affairs to UNSC.

India's

Petronet and Qatar's Ras Laffan LNG Company (Rasgas) have

signed an agreement for the provision of 10.3 billion cubic

meters per year of LNG, and deliveries began in January 2004.

India has also taken equity stake in

Russia’s

Sakhalin oil/gas fields.

Besides already having secured sizeable oil supplies from

Tehran, Japan two years ago sealed a deal with Iran on a

billion-dollar project to develop Azadegan oil field,

estimated to hold the World's second-biggest single oil

reserves. Of late

Washington

has raised objections to this deal.

Iran as

Japan's

third-largest oil supplier provides 14% of

Tokyo’s needs.

Japan has

also made large investments in the development of Russia’s

Siberian oil and gas fields. Offshore of Russia’s Sakhalin

Island, Japanese companies are participating in the first $10

billion slice of what could be a $100 billion development of

oil and gas reserves believed to rival the North Slope of

Alaska. Japan imports nearly 60 percent of its oil from the

Arab countries.

With gas emerging as an equally valuable energy source,

China

and Japan are shadowing each other in the East China Sea. With

China laying a 300-mile gas line to offshore deposits, Japan

has complained that China will tap into a 246 billion cubic

meter gas field that is partly Japanese. With each country's

exclusive economic zone in dispute,

China's

moves to develop the gas have been met by Japanese

naval/survey ships, exploring the contested area in the

southern tip of

Okinawa

Prefecture.

In the rivalry between Japan and China for Russia's eastern

petroleum, China seems to have surged ahead as during his

recent visit to

Beijing

on 21–22 Mar 06, Putin declared that

the planned natural gas pipeline to

China would begin delivering gas within five years and supply

up to 80 billion cubic meters annually. The gas supplies would

come from fields in both western and eastern Siberia.

Russia has also promised to ship 15 million tons of crude oil

in 2006, more than a tenth of China’s needs.

Race for Pipelines

Baku–Tblisi–Ceyhan

(BTC) Pipeline.

The 1,700 km, $3.6 billion

Baku

(Azerbaijan)– Tblisi (Georgia)–Ceyhan (Turkey) oil pipeline

that opened in May 05 is a

US

sponsored move to bypass Russia, Black Sea and Bosphorus for

oil supplies from

Azerbaijan and

other states of Central Asia. It plans to eventually pump one

million barrels of oil per day up to the Mediterranean Sea

close to the Syrian coastline. The present US thrust against

Syria could well have more to do with the fact that the Syrian

coastline is too close to where this pipeline ends than with

the so-called foreign insurgents in Iraq. Question marks about

BTC’s economic viability have arisen as the Azeri oil wells

are depleting and Kazakhstan is yet to commit its oil to this

pipeline. The

US

is trying hard to persuade Alma Ata to opt for the Baku–Ceyhan

pipeline for the flow from the Kashaghan oilfields and

president Bush is due to visit Kazakhstan later this year. Tblisi (Georgia)–Ceyhan (Turkey) oil pipeline

that opened in May 05 is a

US

sponsored move to bypass Russia, Black Sea and Bosphorus for

oil supplies from

Azerbaijan and

other states of Central Asia. It plans to eventually pump one

million barrels of oil per day up to the Mediterranean Sea

close to the Syrian coastline. The present US thrust against

Syria could well have more to do with the fact that the Syrian

coastline is too close to where this pipeline ends than with

the so-called foreign insurgents in Iraq. Question marks about

BTC’s economic viability have arisen as the Azeri oil wells

are depleting and Kazakhstan is yet to commit its oil to this

pipeline. The

US

is trying hard to persuade Alma Ata to opt for the Baku–Ceyhan

pipeline for the flow from the Kashaghan oilfields and

president Bush is due to visit Kazakhstan later this year.

Kazakhstan–China

Pipeline.

On 15 Dec 05, the state-owned China National Petroleum Corp (CNPC)

inaugurated an oil pipeline running from Kazakhstan to

northwest China. The pipeline undercuts the geopolitical

significance of the Washington-backed Baku–Tbilisi–Ceyhan (BTC)

oil pipeline which opened earlier last summer amid big

fanfare. Corp (CNPC)

inaugurated an oil pipeline running from Kazakhstan to

northwest China. The pipeline undercuts the geopolitical

significance of the Washington-backed Baku–Tbilisi–Ceyhan (BTC)

oil pipeline which opened earlier last summer amid big

fanfare.

Making the Kazakh–China oil pipeline link even more

politically interesting, from the standpoint of an emerging

Central Asian move towards some form of greater energy

independence from

Washington,

is the fact that Russian companies have agreed to help fill

the pipeline with oil, until the Kazakh supply is sufficient

thereby implying closer China–Kazakhstan–Russia energy

cooperation. This pipeline runs 962 kilometers and will take

China a third of the way to Kashagan in the Caspian Sea. Once

the link between Kenkiyak and Kumkol is finished, connecting

existing infrastructure near the Caspian with the portion

inaugurated on 15 Dec, the project will pump 1 million bpd.

That would be about 15% of China's crude oil needs. China then

plans to tap into production from dozens of Kazakh sites it

has acquired during the past several years. This is the oil

that currently goes west, or north through Russia. There is

also a proposal to connect this pipeline with the Iran’s oil

from the giant Yadavaran fields which

China

has contracted to develop.

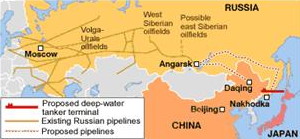

The Japanese Route –– Angarsk–Nakhodka

The Chinese/Japanese competition for becoming the primary partner for Russian energy exports from

the Far East is much less a commercial competition than a

complex game as in the case of the Baku–Ceyhan oil pipeline

where geopolitical considerations far outweigh any and all

commercial aspects. The Japanese route, from

Angarsk

to Nakhodka, would be roughly double the price and, at a

projected 3,700 kilometers, would be significantly longer than

the Chinese alternative to Daqing. For

Tokyo,

the Angarsk–Nakhodka pipeline is significant for two strategic

reasons. First, the pipeline could result in a substantial

reduction in Japan's reliance on Middle East oil imports. The

second strategic factor stems from the fact that if Tokyo is

able to conclude a successful agreement with

Russia,

it would represent a strategic reengagement with

Moscow

–– important in view of the marked decline in Japanese

economic and political influence, and even presence, in

Russia. But the main obstacle for this project is the

territorial dispute with Russia over the Kurile Islands which

is rooted in history and remains an unresolved issue.

becoming the primary partner for Russian energy exports from

the Far East is much less a commercial competition than a

complex game as in the case of the Baku–Ceyhan oil pipeline

where geopolitical considerations far outweigh any and all

commercial aspects. The Japanese route, from

Angarsk

to Nakhodka, would be roughly double the price and, at a

projected 3,700 kilometers, would be significantly longer than

the Chinese alternative to Daqing. For

Tokyo,

the Angarsk–Nakhodka pipeline is significant for two strategic

reasons. First, the pipeline could result in a substantial

reduction in Japan's reliance on Middle East oil imports. The

second strategic factor stems from the fact that if Tokyo is

able to conclude a successful agreement with

Russia,

it would represent a strategic reengagement with

Moscow

–– important in view of the marked decline in Japanese

economic and political influence, and even presence, in

Russia. But the main obstacle for this project is the

territorial dispute with Russia over the Kurile Islands which

is rooted in history and remains an unresolved issue.

The

Chinese Route –– Angarsk–Daqing

The Chinese route, running from Angarsk to China's

energy-rich region of Daqing, would be considerably shorter,

at 2,400 kilometers, and significantly cheaper –– costing $1.7

billion as against $5 billion for the Nakhodka terminal, thus

making it practical to build for 600,000 barrels a day of

exports, an amount that the region could produce. The pipeline

would be the largest economic cooperative endeavour between

Russia

and China and significantly during his visit to Beijing on 22

Mar 06, president Putin had affirmed that this project would

be completed within the next five years.

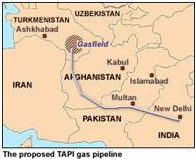

Turkmenistan–Afghanistan–Pakistan–India (TAPI) Pipeline

With a cloud over the Iran–Pakistan–India (IPI) gas

pipeline due to US objections,

India

has virtually decided to join the US-backed

Turkmenistan–Afghanistan–Pakistan–India (TAPI). Paradox-ically,

New Delhi has found an uncommon ally in Islamabad, which is

pushing for India's involvement in the TAP as well as the IPI. Iran–Pakistan–India (IPI) gas

pipeline due to US objections,

India

has virtually decided to join the US-backed

Turkmenistan–Afghanistan–Pakistan–India (TAPI). Paradox-ically,

New Delhi has found an uncommon ally in Islamabad, which is

pushing for India's involvement in the TAP as well as the IPI.

Afghanistan

and Pakistan have been seeking India's participation as vital

for the TAPI's viability, which would stretch from the

Turkmenistan–Afghanistan border in southeastern

Turkmenistan

to Multan, Pakistan (1,270 kilometers), with a 640km extension

to

India.

The TAPI not only provides a southern exit route for the

land-locked Central Asian gas that will not have to cross Iran

or Russia, it is also an important cog in Washington's Afghan

rehabilitation plan as it will earn substantial transit fees.

With potential hydrocarbon reserves of over 45.44 billion

tonnes of oil equivalent, Turkmenistan can significantly

increase supplies to the international market. As on 18 Mar

06, Pakistan has decided to start the $5 billion pipeline

project to import gas from Turkmenistan provided Ashgabad

confirms availability of sufficient reserves.

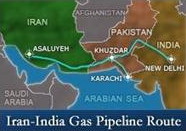

Iran–Pakistan–India (IPI) Gas Pipeline.

While India, Pakistan and Iran go through the motions of

pursuing the IPI project, apparently unaffected by the

International Atomic Energy Agency's referral of

Tehran

to the UN Security Council, most observers claim that the

prospects of the pipeline materialising are now remote. The $7

billion pipeline that Washington opposes would be 2,700

kilometers long and was first proposed in 1994 but progress

has been slow, firstly due to tensions between the nuclear

armed rivals and neighbors India and Pakistan and secondly

because USA has put it on the chopping block. motions of

pursuing the IPI project, apparently unaffected by the

International Atomic Energy Agency's referral of

Tehran

to the UN Security Council, most observers claim that the

prospects of the pipeline materialising are now remote. The $7

billion pipeline that Washington opposes would be 2,700

kilometers long and was first proposed in 1994 but progress

has been slow, firstly due to tensions between the nuclear

armed rivals and neighbors India and Pakistan and secondly

because USA has put it on the chopping block.

All the same, the three sides have been talking and there are

some differences over the pricing. Another one is on terms of

payment.

Iran insists

that India sign a "take-or-pay" contract, meaning that India

would be obliged to pay for gas whether the gas was actually

imported and consumed. But India has suggested a

"supply-or-pay" arrangement in which Iran is contractually

obligated to deliver gas at the Indian border with Pakistan,

or else pay for the quantity not delivered. Further, the

Iranian vice president Rahim Mashaee during his visit to Delhi

on 27 Mar 06 said there is “good news” on IPI and in-principle

clearance had been given.

The

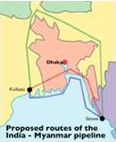

Myanmar–China Gas Pipeline.

Myanmar

is taking India for a ride on supplying gas from fields where two Indian state owned companies hold 30%

equity. While assuring

New Delhi’s

share, it is going ahead with plans to lay an export pipeline

to China in return for soft loans to jack up its own drilling

capabilities. Myanmar has been getting impatient with

India

over the delay in settling the transportation issue over the

Myanmar–Bangladesh–India (MBI) pipeline.

from fields where two Indian state owned companies hold 30%

equity. While assuring

New Delhi’s

share, it is going ahead with plans to lay an export pipeline

to China in return for soft loans to jack up its own drilling

capabilities. Myanmar has been getting impatient with

India

over the delay in settling the transportation issue over the

Myanmar–Bangladesh–India (MBI) pipeline.

The survey by PetroChina for laying a 2,380-km pipeline from

Myanmar’s Kyaukphyu in the Bay of Bengal to Ruili in China

has been completed. China’s MoU with

Myanmar envisages supplying 6.5 tcf (trillion cubic feet) of

gas for 30 years from Block ‘A-1’ field in which ONGC Videsh

owns 20% and GAIL 10% equity. Now the available block

close to Bangladesh bordering area is ‘A-2’ and if the Myanmar

authorities want to sell gas to India, at least 150 km

additional pipeline will have to be built to bring gas to

India. The earlier project was mainly designed to bring gas to

India from Myanmar's A-1 block, which is near to Teknaf of

Bangladesh.

Myanmar–Bangladesh–India

(MBI) Gas Pipeline. A year after

India, Myanmar and Bangladesh signed a trilateral pact to

collaborate on the MBI project, serious doubts over its

viability have arisen due to differences over many other

issues between New Delhi and Dhaka. Bangladesh signed a trilateral pact to

collaborate on the MBI project, serious doubts over its

viability have arisen due to differences over many other

issues between New Delhi and Dhaka.

Though

Bangladesh stands to earn substantial transit fees of $125

million per year, it has set conditions that include creation

of corridors through

India

to carry out trade with other neighbors, such as Nepal and

Bhutan, as well as steps to reduce its $2.5 billion trade

deficit with India. New Delhi appears to have made up its mind

to bypass Dhaka, even though the cost of the pipeline stands

to increase substantially. At the third meeting to which

Bangladesh was not invited, New Delhi talked of the

possibility of constructing the pipeline from Myanmar into

Mizoram and onwards to Assam and culminating in West Bengal.

The shortest pipeline route is from

Myanmar

to Bengal through Bangladesh while the alternative land route

would be twice the distance. India is also considering

shipping the gas as LNG/CNG, in an

undersea pipeline or a swap deal.

Conclusion

The race for

energy resources in Asia is being run by many contenders some

established ones and the others as new entrants. Russia has a

historical advantage and with

China and

Iran in the

team, it seems to have checkmated

USA for the time being.

China is

likely to substantially reduce its oil imports by sea from

Iran and Middle East thus avoiding American military threat

from sea and airborne attacks. However, Japan and India will

have to depend mostly on this mode of supply which requires

constant maritime security. Does that mean greater

US–Japan–India naval cooperation? What problems could Pakistan

in league with China pose to India with its Gwadar port nearly

ready? Could Iran–Pakistan–India pipeline be an antidote?

Answers to these questions lie in how the concerned countries

would act in pursuance of their respective interests. But the

next 20 years are going to be filled with tremendous interest

and excitement.

India will be

watching the expanding horizons of Russia–China energy

cooperation with mixed emotions. Last year at a meeting of the

newly constituted business council in Vladivostok between the

foreign ministers of India, China and Russia, New Delhi had

signaled that energy cooperation is at the top of its

concerns, while working with Russia and China in a new spirit

of regional cooperation. Russian–Chinese cooperation holds

implications for India in terms of the politics of energy

security. It underscores the reality that while nuclear energy

could be an option for meeting energy needs in the medium and

long term, oil and gas will remain the main sources of energy,

at least for the next quarter century –– especially gas.

India

would therefore have to closely monitor how the

Russian–Chinese equations develop in the fields of oil, gas

and nuclear energy.

India also

cannot overlook that Russia and Iran are the only viable

sources of gas supplies for the Indian market. Also, Russia

virtually controls the entire gas flows of the post-Soviet

space, including Central Asia. From the perspective of energy

diplomacy, therefore, India's friendly relations with Russia

and Iran assume a greater criticality than ever. This brings

back to focus the Iran gas pipeline project for India (IPI),

no matter what

Washington

may tell Delhi. Furthermore, in the light of the upcoming gas

pipelines from

Siberia into

China, Delhi

should look seriously at the viability of extending these

Russian pipelines to India through China in possibly in a

rough north–south direction along the existing railway lines

and roads in Kazakhstan and the Xinjiang region of China. For

any of the possible pipeline grids, the hubs would be Urumchi

and Kashgar in Xinjiang and then to Yarkand, Shahudullah and

India.

China holds the key to the success of such pipeline

alignments.

China could

conceivably be interested in swap deals with

India,

namely, buying India's oil and gas in Sakhalin in exchange for

the oil and gas produced in its assets in Xinjiang and

Kazakhstan. There could be an overland route via

India

to China for the Persian Gulf region oil/gas (extension of IPI)

which can do away with the long and perilous supply lines

through the Indian Ocean via the Malacca Strait and the South

China Sea. The proposed TAPI could also be extended to

Kazakhstan

to integrate the Central Asian oil and gas resources. All this

may appear wishful thinking but economic interests invite us

to give these ideas serious consideration and diplomatic

momentum. In the present day world, economic interests

overwhelmingly drive national policies and can bring what

appears far fetched today, in the realm of reality tomorrow. |